Market Reports

December 10, 2024

Regional Property Market Update Winter 2024: Scotland

As we wrap up what has been a strong year for the housing market, it has fared better than expected with inflation under control and the bank rate on a downward trend. The improving outlook has provided increased certainty for buyers, resulting in a rebound in market activity and a return to price growth.

Economic round up

Starting the year at 4.0%, CPI inflation has steadily decreased toward its 2.0% target, and while it was higher than expected at 2.3% in October, it is forecast to remain close to the target in 2025 (ONS). The Bank of England reduced interest rates to 4.75% in November, down from 5%, a welcome optimism boost for the housing market, with consensus forecasts projecting a drop to 4% or lower by the end of 2025*. Approximately 640,000 mortgage holders on tracker rates will feel an immediate boost to their finances, and an additional 770,000 on standard variable rates should receive at least some of the cut.

*HM Treasury, Average of Independent Forecasts November 2024

Optimism boost

Even though the latest cut did not flow through to fixed mortgage rates, it gave a further boost to sentiment and rates are still lower than a year ago. The average two- and five-year fixed-rate mortgages are currently at 5.08% and 4.85% respectively, showing a year-on-year decrease of -0.47% and -0.28%*. The next Bank Rate cut should further boost optimism amongst movers and help to improve affordability through 2025. Mortgage approvals in October reached 68,303, the highest level since August 2022, as market activity builds. This marks a 42% year-on-year increase and a 3% rise compared to October 2019 (Bank of England).

*Podium, 26 November 2024

Buyer groups

Sales activity has been given a boost, driven by a mix of first-time buyers and existing homeowners who had delayed their moving decisions until borrowing costs declined and the outlook improved. First-time buyers are on track to be the largest buyer cohort in 2024, making up 36% of all sales (Zoopla). This is followed by existing homeowners with a mortgage (31%), while cash buyers (consisting of mortgage-free homeowners and investors) are on track to make up 27% of sales. Investors using buy-to-let mortgages are expected to make up the balance, their numbers impacted by rising mortgage rates.

Active market

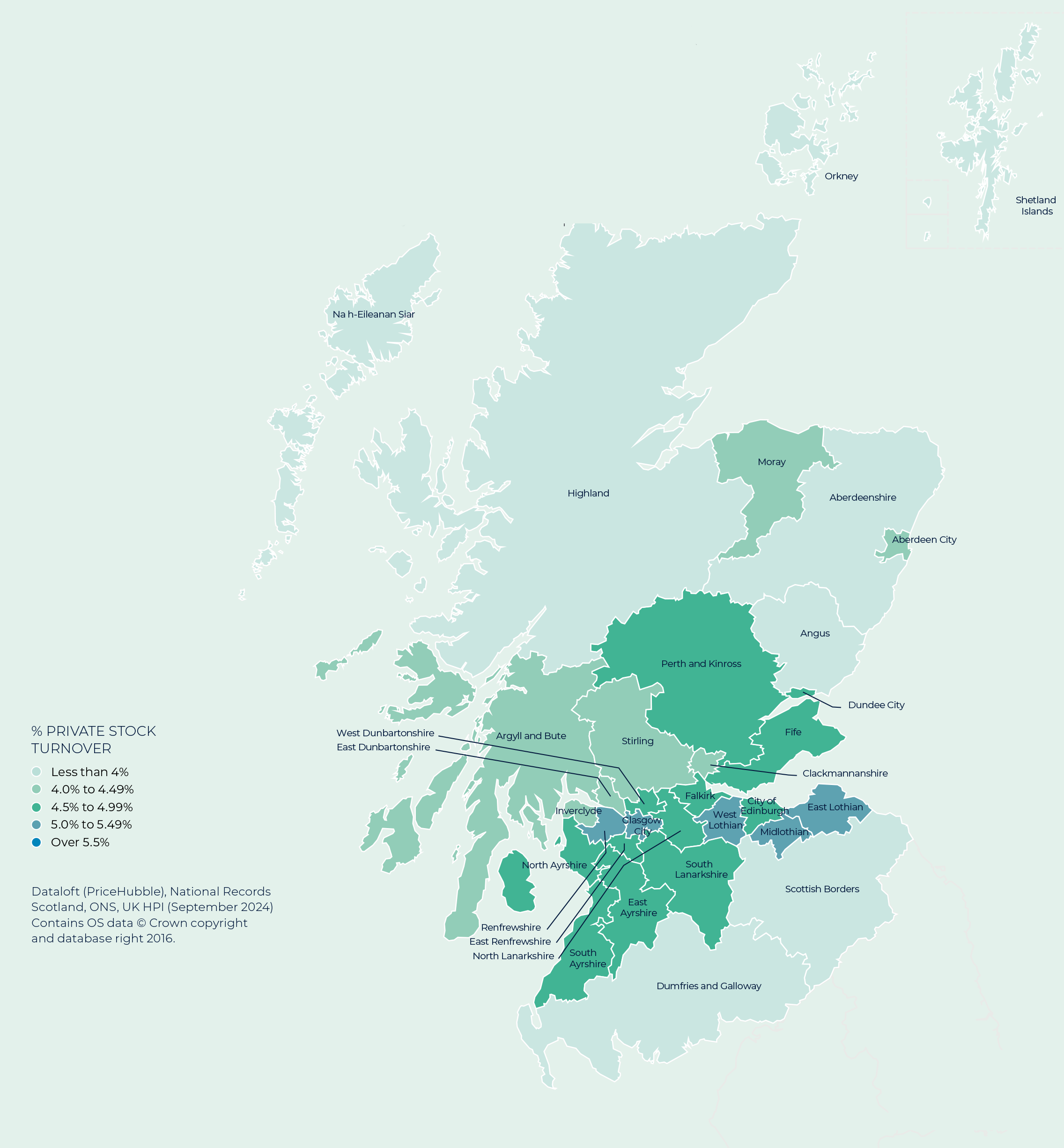

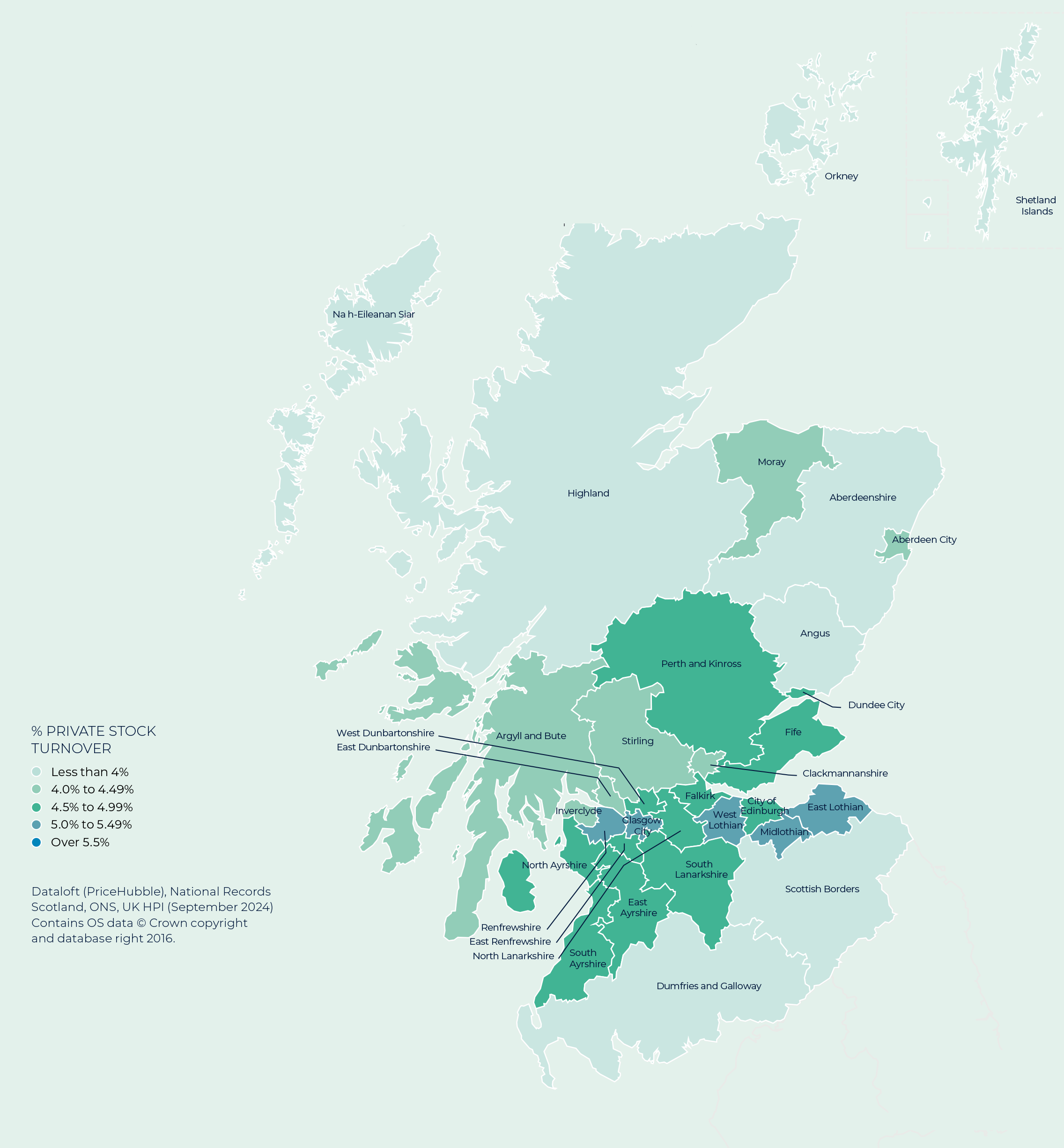

Transaction activity continues to build, with 100,410 transactions in October, the highest level since November 2022 (HMRC). Scotland has seen the highest rate of property turnover of any region in the UK over the past year. Across Scotland, the most active housing markets are currently those of East Lothian, Midlothian and Renfrewshire, where close to one in every 19 properties has changed hands in the past year.

Contact us

Sell your property with your local expert this winter. Contact your local Guild Member today.