Market Reports

August 27, 2024

Regional Property Market Update Summer 2024: Southern

The property market continues its steady recovery. As momentum builds, buyer demand, transaction levels and prices are rising. All eyes are on the Bank of England for an imminently expected interest rate cut.

Interest rate

The UK economy grew by 0.6% between January and March 2024, marking the end of the recession (ONS). With inflation falling to just 2.3% in the 12 months to April 2024, close to its 2% target (ONS), the Bank of England is widely anticipated to cut the base rate imminently. Economists at Capital Economics are forecasting the base rate to be at 4.5% by the end of 2024, with the first cut expected in August. With the economic outlook brightening, consumer confidence in May rose to its highest level since December 2021 (GfK Consumer Confidence Tracker).

Election

Rishi Sunak has announced a 4th July general election. Some fear an election could stall market activity, but this was typically when a significant policy change, such as Mansion tax, was mooted, which isn’t the case this time round. The first interest rate drop is expected to have a larger impact on activity this year. The election is unlikely to interrupt seasonal patterns of transactions, which typically peak in July and August anyway (Dataloft (PriceHubble), HMRC). With the sales pipeline already 3% higher than this time last year (Zoopla) it's unlikely that buyers already in the process of working to a sale will pull out.

Reviving market

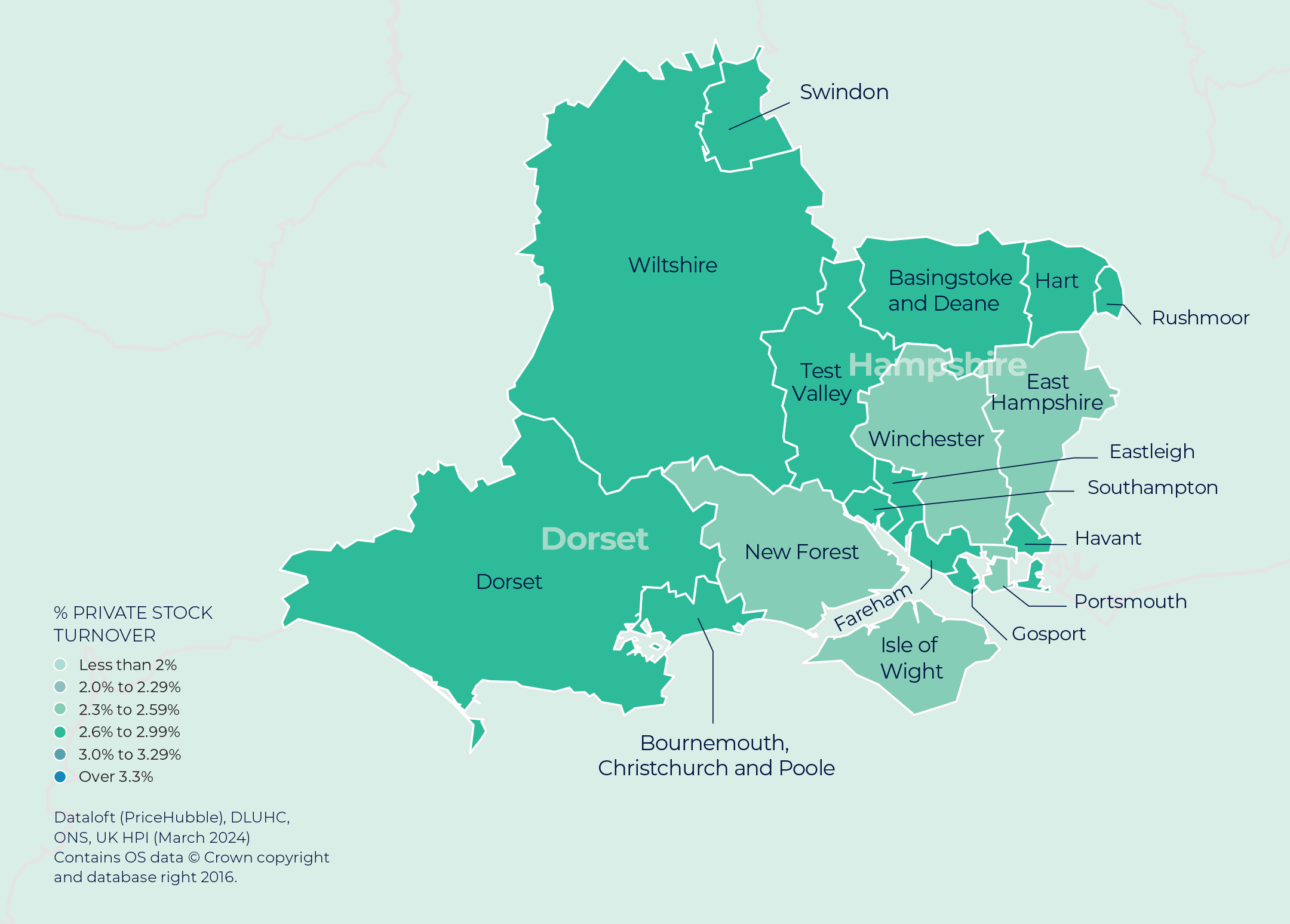

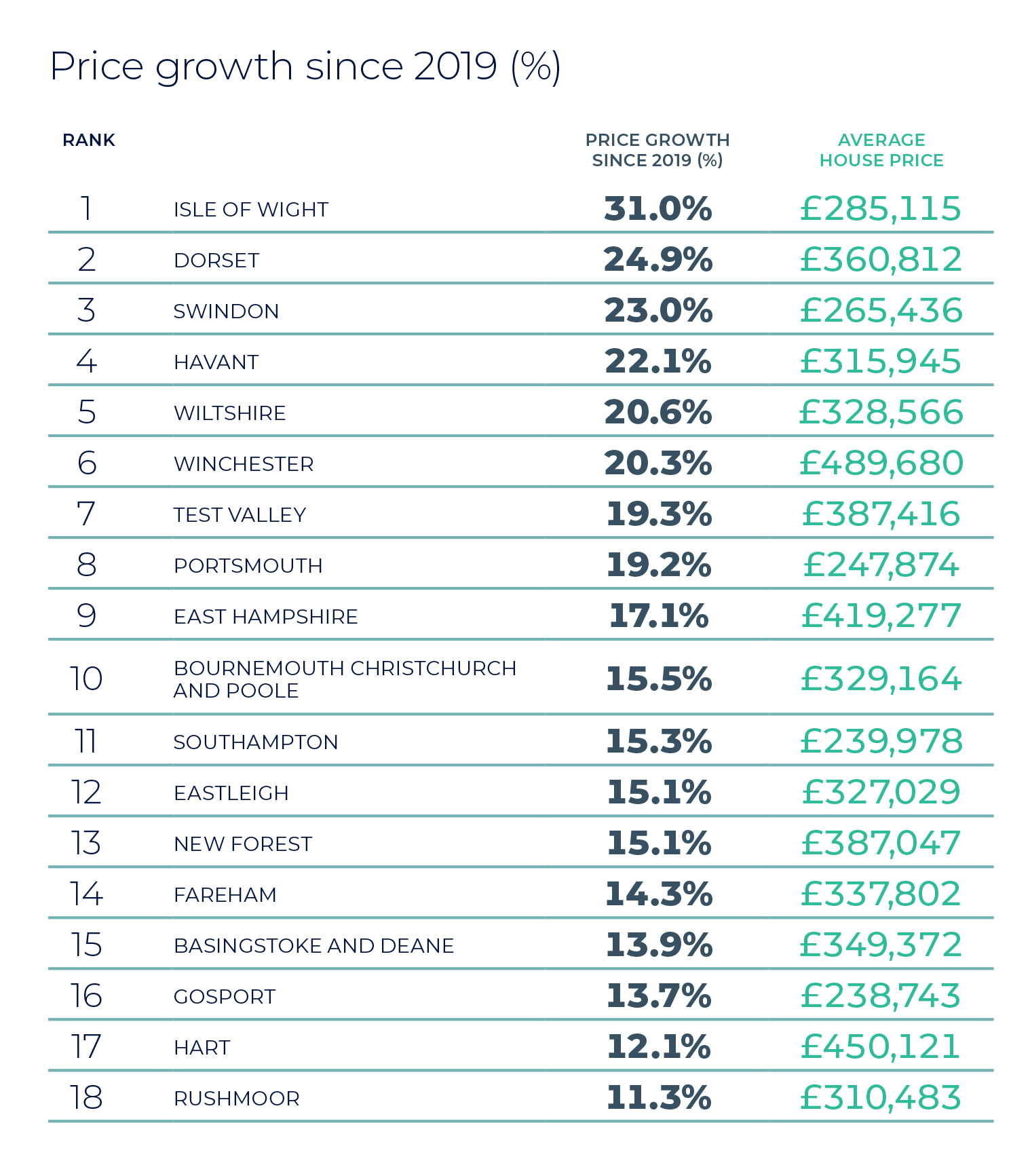

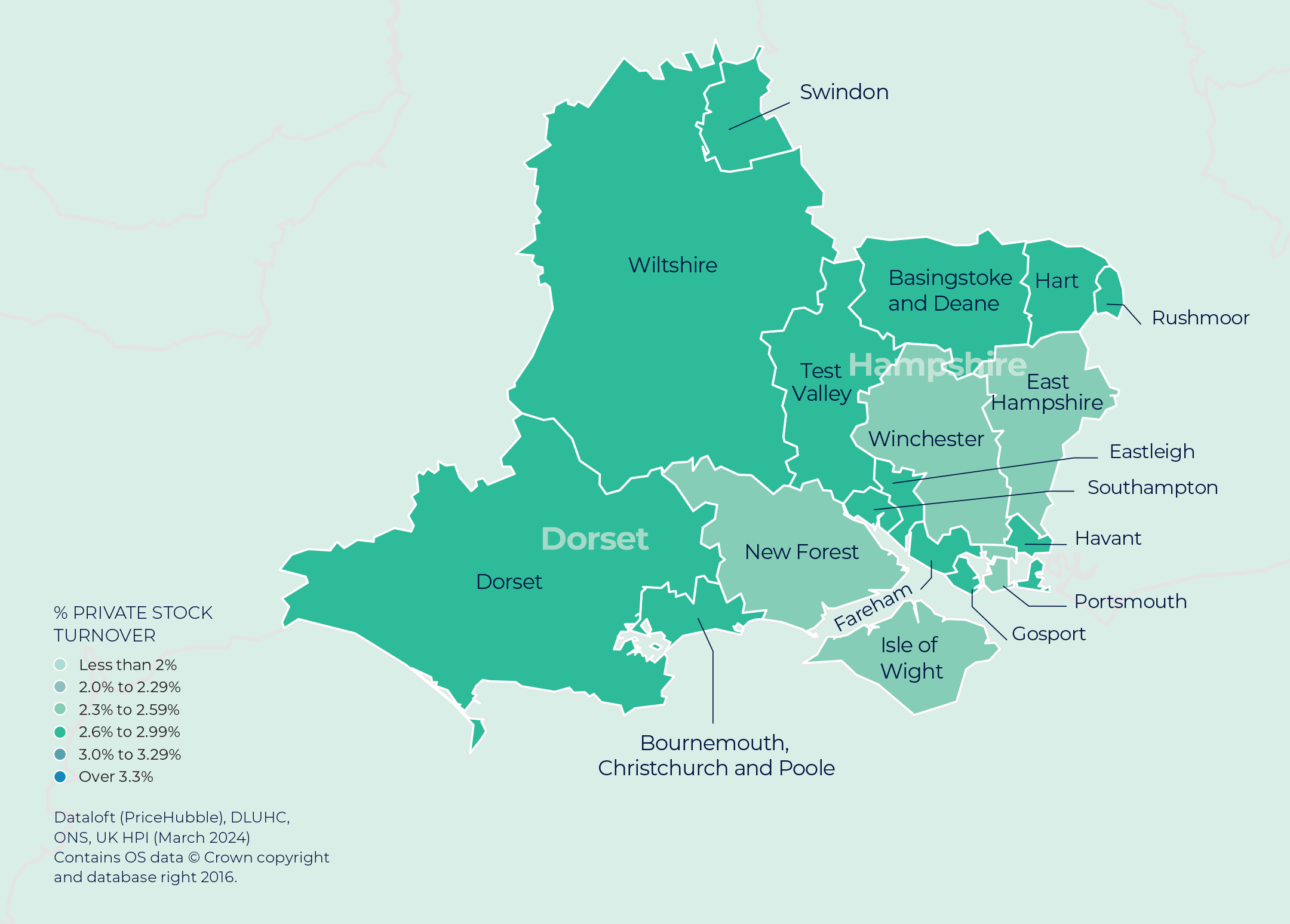

Transaction levels continue to recover, having climbed to their highest point since March 2023 and up 9.8% year-on-year (HMRC). This indicates a reviving property market, as improving economic conditions help ease household financial pressures. Despite mortgage rates remaining elevated for longer than anticipated, pent-up demand alongside the usual seasonal boost is driving increased buyer and seller activity. The market is experiencing a sustained uplift in sales, with 13% more agreed than a year ago. The sales pipeline is steadily rebuilding, and the market is on track for close to 1.1 million sales in 2024, a 10% increase on last year (Zoopla). Across the Isle of Wight, Dorset, Hampshire, Wiltshire, the most active housing markets are currently those of Swindon, Eastleigh and Hart, where close to one in every 35 properties has changed hands in the past year.

More choice

There are a fifth more homes available than the same time last year, the highest level of supply in eight years (Zoopla). The average agent outside of London now offers twice as many 4+ bedroom homes compared to February 2022, whilst there are 25% more three-bed homes available compared to a year ago, promising news for families looking to upsize. Increased supply is giving potential buyers more choice, however affordability is a key factor affecting budgets.

Contact us

Sell your property with your local expert this summer. Contact your local Guild Member today.